By Mike Dabadie

This is Part 1 in a two-part series about the trends and forces influencing the lives of Americans in the coming months. Read Part 2.

These days it seems the signal lights of life (everything from the media to technology, science to politics, the economy to the environment) are flashing a confusing constellation of colors — some say recently alarming from yellow to red. Yet, we know from history that these signals, and the forces behind them, change in a non-linear order, which means divining these patterns can be difficult, if not impossible. But what we can do is peer into the hearts and minds of those impacted by these signals, forces, and patterns to identify how human behavior reframes to a state of personal and social identity.

As behavioral scientists and strategy advisors, here are the trends that we’re watching for our clients, what we’re seeing in the data, and what we’re hearing from the thousands of consumers and stakeholder interviews from around the world that we’ve spoken with through various insights and strategy platforms.

Are Americans spending or holding their dollars?

Today, there is a growing consensus among economists of a potential global recession bringing about higher unemployment, rising interest rates, stubbornly high inflation, and reduced personal cash flows. The VIX in the U.S., a strong indicator of risk sentiment, seems to corroborate this prediction from its current 52-week high.

But there are two sides to every story. It might have been John Gerzema at the Harris Poll who coined the term, “revenge spending,” and if so, he nailed it. Despite all the gloom of the past few weeks, global consumer spending has been resilient. In the U.S., Personal Consumption Expenditure (PCE) is the measure that reports actual consumer spending and it has been riding. According to the Federal Reserve, in the last 12 months through August 2022, the PCE price index increased 6.2% after advancing 6.4% in July.

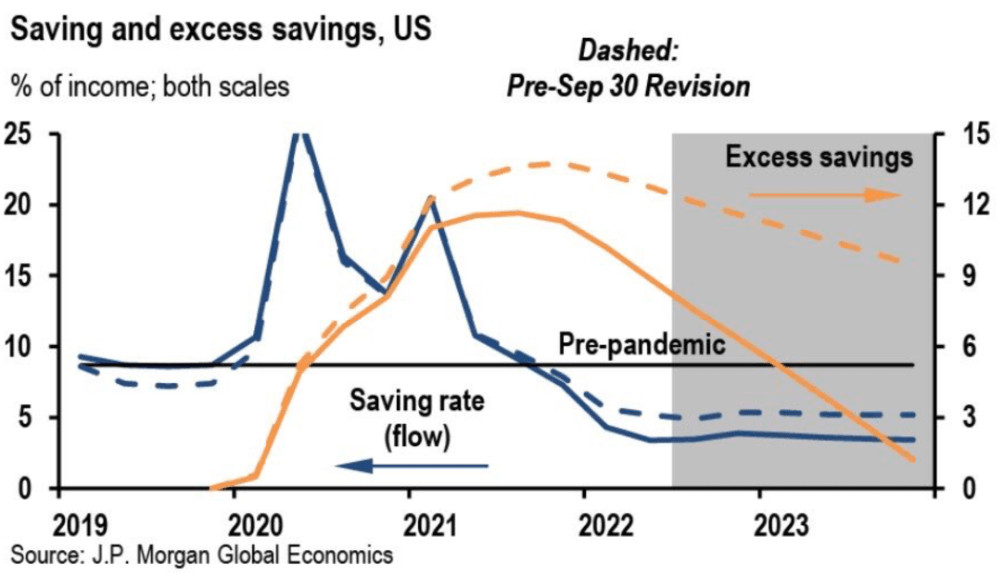

This is a major reason why inflation has been stubbornly high and hard to reduce – consumers continue to spend and buy even if prices are higher than usual. But where are consumers getting the money to spend? Extra spending cash is most likely coming from personal savings that piled up during the COVID lock down and because of COVID relief government stimulus money. However, U.S. savings are starting to decline (see below chart) and this may be the catalyst to reduce inflation and yet risk a global recession.

Future Implication: Consumers might have been locked down by COVID, but they were not locked out. The travel rebound, as one example, shows that humans crave experience and social interaction. As long as they have money to spend, they will spend it on brands and experiences that help them forget the restrictions of 2020.

Do “green” brands get more dollars?

In a recent global survey conducted by GWI1, the top three factors influencing brand selection are reducing company carbon emissions/energy use (47%), using sustainably sourced materials (46%), and transparency on how a product is created (41%). However, this same research also shows that older age groups are less likely to consider any of these factors compared to their younger cohorts.

But this type of question fundamentally begs for a socially biased response. Who would say they don’t care about sustainability? Rather than wording this one-way, it’s best to ask if one would be more likely to purchase (reward) or avoid (punish) a brand, company, or leader that addresses sustainability.

Future Implication: In fact, consumers are more likely to punish a brand than reward. Sustainability is now greens fees, not green washing. But you need to have a high-quality product that meets the needs and delivers the personal benefits (functional and emotional) to even be in the game. Faking it eventually runs out of runway in this world of instant information.

Where will Gen Z start putting their dollars?

The worldwide population is expanding, projected by the U.N. to reach 10.9 billion by 2100 vs. 8.0 billion now in 2022. Part of this increase comes from a fast-growing generation — Gen Z at 2.8 billion, which is currently 35% of the total global population. This generation has grown up with the power of internet, mobile phones, and social media in the palm of their hands. This digital proliferation is causing a change in values for Gen Z vs. older generations, where those in this younger generation say they place higher priority on social causes and collectivistic values.

Future Implication: Align your brand characteristics and organizational values with those values of your most important audience; understand what’s important to them and appeal to a range of values and priorities, not a one-size-fits-all mandate. This is unlikely to change soon and now crosses generations.

1 GWI, GWI Zeitgeist March; Base: 12,890 Internet users in 9 markets aged 16-64